Mathematical and statistical probability blindness is something I always see in most new traders entering the market. In this article, I will summarize some of the most essential mathematical formulas for those who intend to be serious about trading.

Mathematical and statistical probability blindness is something I always see in most new traders entering the market. In the book "The New Trading for a Living", Professor Alexander Elder once said that many traders lose money because of mathematical blindness. New traders do not understand or misunderstand some of the basic mathematical principles in trading, so they always encounter difficulties in trading.

In this article, I will summarize some of the most essential mathematical formulas for those who intend to be serious about trading.

Margin

If you have participated in the FOREX market, using leverage is very important. The contract size in forex is calculated in Lots and 1 Lot = 100,000 units. Because, forex traders (individuals) never have enough money in their accounts to buy or sell 100,000 USD when opening an order, using leverage is not strange in this market.

In the cryptocurrency market, years ago, using leverage in trading was relatively difficult. However, at present, using leverage in trading is becoming more and more popular, especially when using futures contracts.

Here, you can use your $1 deposit to trade with a leverage of up to 100 times, 150 times the amount of money you have, yes you can trade a large amount of money with just a relatively small deposit of your money.

But you should remember that, when you want to use margin services to trade, you must know a ratio, which is the margin ratio. For example, the margin ratio is 2%, which means you are using a leverage ratio of 50:1.

Leverage = 1 / Margin

50:1 = 1/2% = 1/0.02

So what does this ratio mean? What does it mean to use it in trading?

As in the example above, the margin ratio is 2%, which means that when the price fluctuates from the price you started the long or short position by 2%, you will get 100% of the bet amount or lose everything.

For example:

You enter a Long BTC order at the price of $10,000 with a leverage of 50 and your deposit is $1,000. The margin rate is 2%.

Your transaction will be like this:

1000*50/10000= 5. You will buy 5 BTC with a leverage of 50x and a deposit of $1,000.

The margin rate is 2%, equivalent to 2%*10000=200, then when the price fluctuates up to $200 in line with your prediction, you will profit $1,000 and vice versa, the price decreases by $200, you will lose $1,000.

Note: the exchanges have a mechanism to reduce the % rate to calculate the liquidation price. Normally, I calculate that if the position decreases by 80%, they will liquidate your order.

Looking at the above transaction, you see that the number of losses is limited while the number of wins is unlimited, right? Unfortunately, this is contrary to your thinking.

According to many statistics from trading floors, the higher the leverage, the greater the possibility of a Margin Call. With a leverage of 50, the probability of a Margin Call is 30% while traders using a leverage of 10:1 have a probability of a Margin Call of less than 5%.

This means that when you make a transaction without leverage, the average win-loss ratio is always 50/50. When you use a leverage of 50x, you have an additional 30% loss ratio, reducing your average win rate to only 20% - 30%.

Calculating Position Sizing

There are 4 steps to calculate your position size with 4 parameters as follows

- Account size (let's say 50,000 USD)

- % of your account you are willing to bet per trade (let's say 2%).

- Coin purchase price (let's say 45 USD)

- Stop loss price (let's say 40 USD)

We will calculate the position size as follows:

Step 1: Calculate the amount you bet.

- Risk = Account size x % risk per trade.

- Here is: 50,000 USD x 2% = 1000 USD. That means you are willing to lose 1000 USD for each trade.

Step 2: Calculate Loss Ratio

- Loss Ratio = 1- (Stop Loss Price/ Current Price)

- Here: 1- (40/45)=11%

Step 3: Calculate Position Size

- Position Size= Risk/Loss Ratio

- Here: 1000 USD/ 11%= 9090 USD

Step 4: Number of coins to buy

- The number of coins to buy = Position size / current coin price.

- Here is: 9090 USD/45 USD= 202 coins.

The four steps above are just the basic steps for you to calculate your position size. Depending on the market, there will be more complex calculations to calculate the most accurate number.

System's Mathematical Expectancy (Or Edge)

You need the following 4 parameters to easily calculate the mathematical expectation of the system. Mathematical expectation represents the amount of money you earn after a series of transactions

- Win rate (for example 60%). This means the loss rate is 40%.

- Account size (for example 50,000 USD).

- Risk per transaction (for example 1% of the account or 500 USD).

- Risk/Reward Ratio. For example, here it is 2:1

Mathematical Expectancy = Win Rate x (Account Size x Risk per Trade x Profit/Risk Ratio)- Loss Rate x (Account Size x Risk per Trade)

In the example above, we will have: 60% x (50,000 USD x 1% x 2)- 40% x (50,000 USD x 1%)= 400 USD.

Your system earns an average of 400 USD per trade.

Probability of Having a Losing Trade or Winning Trade.

You need statistics on the win rate to calculate this probability. For example, here the win rate is 60% and the loss rate is 40%.

Probability of Winning Streak

- 2 wins in a row = 60% x 60% = 36%

- 3 wins in a row = 60% x 60% x 60% = 21.6%

- 4 wins in a row = 60% x 60% x 60% x 60% = 13%

You can do the same for losing streaks.

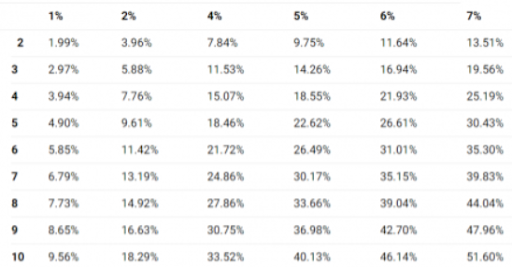

The following graph shows the probability of having a winning (or losing) streak with different win rates.

Calculating Account Loss Level and Recovery Rate

If you risk 2% of your account per trade and have 2 consecutive losses, it will not make your account lose 4%, but only 3.96%.

The formula is 1- [(1-0.02) x (1-0.02)] = 3.96%

Similarly, having 3 consecutive losses will reduce your account by 5.88%, not 6%.

The formula is 1- [(1-0.02) x (1-0.02) x (1-0.02)]= 5.88%.

The following table calculates the drawdown based on your losing streak and each risk level for each trade.

The problem with big losses is that you need a larger profit to get back to where you started. If your account is down 70%, you need a 233% gain to get back to where you started. The chart below illustrates it all.

Checking Profitability

You can see the relationship between Win ratio and Risk/Reward ratio.

The formula is as follows: Required Win Ratio = 1/ (1+ Risk/Reward Ratio).

For example, if you have a 5:1 risk/reward ratio, your required win ratio is 1/ (1+5)= 1/6= 16.7%.

Professional traders often increase their risk/reward ratio while accepting a decrease in their win rate.

The following chart shows the relationship between these two metrics.

-------------------------------------

👉Join Cryptocurrency Exchanges with Exclusive Offers from TonyCapital

.png)

.png)

.png)